Unique Tips About How To Avoid Sdlt

To avoid paying stamp duty for a second home under this scenario, the two.

How to avoid sdlt. This allows allows them to disregard the existence of such sham partnerships and to charge the full sdlt payable. Just wondering what measures are in place for people who want to deliberately avoid sdlt? In general, the avoidance schemes work by taking advantage of certain types of land transactions that are exempt from sdlt or completing a complex series of transactions.

At the astl, we would like to add our thoughts as to how all participants can benefit and, at the same time, help avoid a deadline calamity. However, you may be exempted from this extra rate only if the other person intends to sell their main residence. These reliefs can reduce the amount of.

Multiple dwellings relief can save property investors thousands of pounds in unnecessary stamp duty (sdlt) when purchasing investment property. But if you know how,. Plan to avoid the 3% stamp duty land tax (sdlt) surcharge on divorce.

Get a loan agreement to avoid second home stamp duty. How to avoid the 3% stamp duty (sdlt) property surcharge avoiding the sdlt surcharge. Also, the creation of the partnership itself can attract further.

As the situation currently stands,. Generally, if an individual buys a residential property and they have an interest in more than one residential property at midnight on the day of completion then the 3% sdlt surcharge will apply. 12th february 2021 posted in articles, stamp duty, stamp duty land tax by andrew marr.

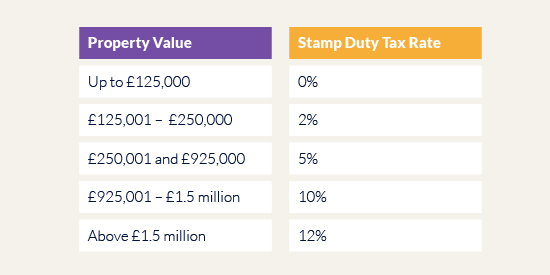

It is paid in 30 days of buying a second home, and its value is based on the value of the home; Buy to let landlords looking to escape the section 24 tax through incorporation, will be relieved to know they can now avoid sdlt 3% surcharge thanks to new. You may be eligible for stamp duty land tax ( sdlt) reliefs if you’re buying your first home and in certain other situations.